Health Savings Account (HSA)

What is a Health Savings Account (HSA)?

A health savings account (HSA) is a tax-sheltered savings account, which is only offered to employees covered under the High Deductible Health Plan (HDHP) medical plan. Aetna provides the underlying health coverage, and HSA Bank is the financial institution that administers the HSAs.

You can make pre-tax contributions through payroll deductions, which reduces your tax liability on your wages.

When you use your account to pay for qualified medical expenses, you can withdraw the funds tax-free.

Any unused funds carry over from year to year and continue to grow tax-deferred.

Additionally, you own the account, so the balance in the account goes with you if you change employment.

Who is eligible to open an HSA?

You’re eligible to open an HSA if you:

are covered under the SPU medical plan (not including SPU's ACA offering),

are not enrolled in Medicare coverage,

don’t have coverage under another non-HDHP medical plan, such as a spouse’s plan (including a spouse’s flexible spending account plan), and

are not claimed as a dependent on someone else’s tax return.

Contributions by SPU to Employee HSAs

| Coverage Selection | IRS Contribution Limit for 2024 | University Monthly Contribution | SPU’s dollar-for-dollar match of employee HSA contributions through payroll |

|---|---|---|---|

| Employee Only | $4,150 | $84 per month | Up to $600 |

| Employee & Dependent(s) | $8,300 | $168 per month | Up to $1,000 |

Will the University contribute to my HSA Account?

Yes, SPU will make monthly contributions to your HSA account (see chart above). If you participate for all 12 months of the year and make your own voluntary contributions from your paycheck up to at least the dollar-for-dollar match, SPU will contribute:

- Individual: up to $1,608 total

- Family: up to $3,016 total

If you enroll mid-year, these amounts will be pro-rated based on the number of months you are enrolled in the SPU medical plan.

PLEASE NOTE: In order to receive HSA contributions, an eligible University employee must first pass the proper background / identity checks run by HSA Bank. This is required because a Health Savings Account is a bank account owned by the employee, so other state and federal banking laws apply. If an employee does not respond and complete identity verification requirements, the HSA contributions will be forfeit until such verification is completed; with only future HSA contributions being made.

How much can I contribute to my HSA Account?

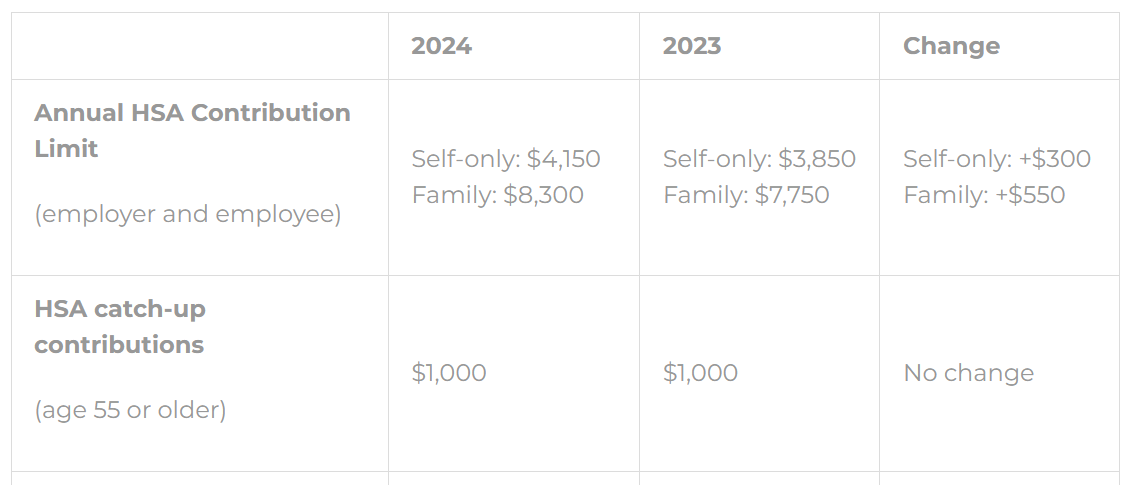

The total amount deposited into your account by you and the University cannot exceed a maximum annual contribution established by the U.S. Treasury. The table outlines the maximum contribution, what the University will contribute and the amount remaining that you can contribute for the tax-year. If you’re 55 or older, you may make additional “catch-up” contributions of $1,000. Please note, you are responsible to make sure that your total HSA contributions (made and received) do not exceed the IRS limits.

The IRS is increasing eligible HSA contributions for the 2024 plan year -

HSAs and FSAs: Can I have both?

To make or receive HSA contributions, neither you nor your spouse can have a Health FSA, but you may contribute to a Limited Purpose FSA option for dental and vision expenses. This means that you can have your HSA as well as this special FSA at the same time.

Like a regular FSA, receipts for the Limited Purpose FSA will need to be submitted for eligibility verification and the monies in the account must be used by the end of the plan year. These are USE-IT-OR-LOSE-IT accounts due to IRS rules and if you are not able to use your funds by the end of the plan year, the remaining funds are forfeit.

Why would I want to have a limited purpose FSA and an HSA?

- Having a limited purpose FSA along with your HSA can allow you to maximize your tax savings. For example, if you anticipate that you will have dental and/or vision expenses this year, you can defer up to the annual FSA maximum into a Limited Purpose FSA, save the taxes on those expenses and leave your HSA funds alone to accumulate for future use. This is commonly done when an employee will be paying for orthodontia services.

Once you reach the federal statutory minimum annual deductible for medical expenses, the monies in your Limited Purpose FSA can be used for medical expenses as well after that date. This is helpful if you anticipate medical costs that will end up exceeding the deductible.

What if I terminate medical coverage or my SPU employment?

- If your eligible position or your coverage terminates, you keep the account balance in your HSA and are responsible for all fees incurred by this account. Contributions can only be made while you are enrolled in a HSA-qualified HDHP but the funds in the account are available for qualified medical expenses, as well as for COBRA or continuation of coverage premiums if on unemployment.

- In this case, the Limited Purpose FSA will terminate based on the last date of employment, and expenses incurred after this date will not be eligible for reimbursement.

- When you terminate your employment, your benefits will run through the last day of the month. You may incur expenses that are HSA eligible through the end of the month you terminate and you will have 90 days from the date of termination to submit receipts for reimbursement from your HSA/FSA/HRA accounts.

Forms

SPU HSA Enrollment and Authorization for Payroll Deduction webform

HSA Accounts don't disappear when you leave employment! Click here to learn more about how to ensure your HSA dollars transfer with you seamlessly.

Additional Resources

- HSA Allowed Reimbursable Expenses - IRS

- Health Savings Account (HSA) Calculator - HSA Bank

- What IS a Flexible Spending Account?

- What IS a Health Savings Account?

- HSA Tax Reporting Information